Georgia’s top economist projected slow job growth and persistent inflation in the year ahead as many Georgia families struggle to make ends meet.

State Economist Robert Buschman told Georgia legislators Tuesday that lower personal debt and improved bank balance sheets are bright spots in his economic outlook. But he said slow job and income growth, rising prices and record business bankruptcies suggest a mixed economic outlook for 2026.

And while he does not believe a recession is imminent, Buschman noted that surveys show consumers and CEOs are pessimistic about the economy.

“The real problem is incomes for most Americans have not kept up with inflation in recent years,” he told lawmakers at the Georgia State Capitol in the first of three days of hearings by a joint legislative committee studying state spending.

The direction of Georgia’s economy is a top concern as legislators negotiate state budgets for fiscal years 2026 and 2027.

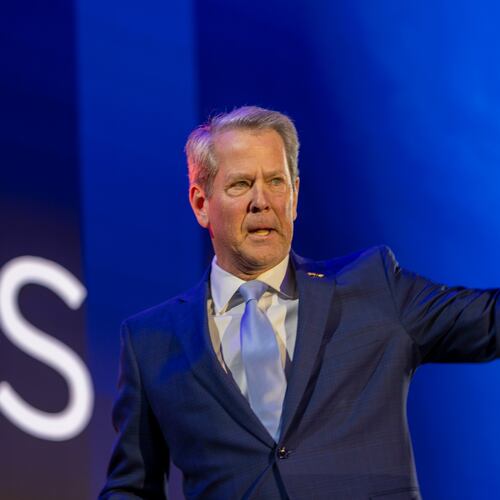

Last week, Gov. Brian Kemp proposed more income tax cuts and rebates and $2,000 payments to state employees as part of his budget plans. House and Senate leaders are working on property and income tax relief proposals as legislators seek to address voters’ concerns about affordability in an election year.

If Buschman’s economic outlook is an indication, those concerns may only be heightened in the year ahead.

On the positive side, the economist noted consumer financial health as measured by debt is strong. Though household debt is rising, it’s still low by historical standards.

Buschman said Georgia has outperformed the nation in employment growth in recent years. Nonfarm employment in Georgia is up 6.7% over the last six years, compared with 4.7% nationally.

But Buschman said job growth stalled in Georgia and across the nation last year. The state gained just 3,200 nonfarm jobs in 2025 through November, and the economist warned of economic headwinds.

He said President Donald Trump’s tariffs have raised prices for businesses and consumers and threaten to undermine Georgia’s trade-dependent economy. Mortgage rates remain relatively high, limiting the sale of homes. And after falling from a peak of 9% in 2022 to 2.4% in September 2024, inflation has since inched back up to 2.7%.

Not surprisingly, Buschman noted that consumers and businesses are feeling the pinch. He said business bankruptcies are at record highs, and a recent survey of CEOs found 64% expect a slowing economy with higher inflation — or “stagflation.”

Consumers surveys show sentiments “typically associated with recessions,” Buschman said.

He said he does not expect a recession soon, but he expects slow job growth and inflation to persist. Throw in the risk to Georgia trade, uncertainty about the employment impact of artificial intelligence and “political instability” in the United States and across the world, and Buschman’s forecast was not a rosy one.

“Anything that pushes inflation higher again is likely to make matters worse for the average consumer,” he said.

About the Author

Keep Reading

The Latest

Featured